Airlines, Airports and Airliners 6 to 16 February 2023

Compiled by Willie Bodenstein

Google Banner Ad

AFRICAN EXCELLENCE HIGHLIGHTED AT THE CANADA-AFRICA RECEPTION IN CAPE TOWN

The continent's largest, award-winning airline commended for accelerating Canada-Africa trade and investment in the context of its global role as one of the world's largest carriers. Ethiopian Airlines' ongoing expansion and existing service was underscored during the Canada-Africa Reception held in Cape Town, ahead of the annual Mining Indaba convention which began on 6 February 2023

Hosted by the Canada-Africa Chamber of Business, Chamber President Garreth Bloor thanked the airline for its vital role in Canada-Africa trade and investment.

''Ethiopian Airlines is the sole airline connecting Canada directly to Sub-Saharan Africa, and onward to over 120 destinations from the African Union capital of Addis Ababa - making it the world's fourth largest airline in this regard.''

The pan-sectoral event over the weekend welcomed Canadian Trade Commissioners, Canadian and African business representatives, as well as members of the press.

Mr. Wondwossen Marou, Traffic and Sales Manager for Cape Town, participated in the event on behalf of the Ethiopian Airlines - receiving applause from attendees in recognition of the successes of the company on the international stage.

''Ethiopian Airlines did not lay off a single full-time employee during COVID, nor sought a bailout. It remains a model of private sector excellence, reflecting both the realized potential of the continent, while setting global standards of excellence in doing so,'' says Jacques NdoutouMvé, a fellow member of the Canada-Africa Chamber of Business who serves as Vice President for Africa at Apollo Health and Beauty.

Ethiopian Airlines says it is proud to be the sole airline partner and sponsor of The Canada-Africa Chamber of Business.

Google Banner Ad

??NTSB RELEASES COMMENTS ON ETHIOPIA'S INVESTIGATION OF THE BOEING 737-8 MAX ACCIDENT

The National Transportation Safety Board published Tuesday the comments it provided to the Ethiopian government on their draft accident investigation report into the 2019 crash in Ethiopia of a Boeing 737 Max airplane.

The NTSB took the unusual step of publishing the comments on its website after Ethiopia's Aircraft Accident Investigation Bureau (EAIB) failed to include the NTSB's comments in its final report on its investigation into the March 10, 2019, crash of Ethiopian Airlines flight 302, a Boeing 737?-8 ?MAX. The NTSB received the EAIB final accident report on 27 December.

In accordance with the provisions of the International Civil Aviation Organization Annex 13, countries participating in the investigation are provided the opportunity to review the draft report and provide comments to the investigative authority. If the investigating authority disagrees with the comments or declines to integrate them into the accident report, participating countries are entitled to request that their comments be appended to the final report.

The EAIB provided the NTSB with its first draft of the report last year. The NTSB reviewed the report and provided comments on several aspects of the accident the NTSB believed were insufficiently addressed in the draft report. The comments primarily were focused on areas related to human factors.

After the EAIB reviewed the comments, it provided the NTSB with a revised draft report for its review. The NTSB determined the revised report failed to sufficiently address its comments. As provided by the ICAO Annex 13 process, the NTSB provided the EAIB with more expansive and detailed comments.

Instead of incorporating the most recent and expanded comments into their report, or appending them as had been requested, the EAIB included a hyperlink in their final report to an earlier and now outdated version of the NTSB's comments.

The NTSB also noted that the final report included significant changes from the last draft the EAIB provided the NTSB. As a result, the NTSB is in the process of carefully reviewing the EAIB final report to determine if there are any other comments that may be necessary.

Google Banner Ad

ICAO FORECASTS COMPLETE AND SUSTAINABLE RECOVERY AND GROWTH OF AIR PASSENGER DEMAND IN 2023

Using advanced big data analytics, ICAO forecasts that air passenger demand in 2023 will rapidly recover to pre-pandemic levels on most routes by the first quarter and that growth of around 3% on 2019 figures will be achieved by year end.

"Assuring the safe, secure and sustainable recovery of air services will be key to restoring aviation's ability to act as a catalyst for sustainable development at the local, national and global levels and will consequently be vital to countries' recovery from the broader impacts of the COVID-19 pandemic," remarked ICAO Council President Salvatore Sciacchitano.

"The air passenger forecasts ICAO is announcing today build on the strong momentum toward recovery in 2022, as previously assessed by ICAO statistical analysis," remarked ICAO Secretary General Juan Carlos Salazar. "Through ICAO, governments have reached agreements on goals toward zero accident fatalities by 2030 and zero carbon emissions by 2050 goals and these will continue to play key roles in both guiding continued progress and in prioritizing ICAO's implementation support initiatives."

The number of air passengers carried in 2022 increased by an estimated 47% compared to 2021, while revenue passenger kilometres (RPK's) increased by around 70% over the same period, due mainly to the rapid recovery of most international routes. In terms of airlines' annual passenger revenues, keeping yield and exchange rates at 2019 levels, ICAO observed growth of an estimated 50% from 2021 to 2022.

In line with earlier ICAO predictions, the strong recovery in air passenger demand has resulted in 2022 passenger numbers reaching an estimated 74% of pre-pandemic levels, while passenger revenues are estimated to have reached around 68% of 2019 levels. The number of passenger aircraft in service in 2022 mirrors the overall traffic recovery, with current estimates suggesting 75% of pre-pandemic levels.

In 2022, aircraft orders and deliveries by major manufacturers Airbus and Boeing grew by 53% for orders and 20% for deliveries, compared to the previous year. The number of orders in 2022 exceeded that seen since 2019, indicating the recovery of aircraft demand.

Current estimates for air cargo in 2022 reflect 2021 levels, while still showing marginal growth compared to the pre-pandemic level. The pace of growth for air cargo is however expected to be lower in 2023, given the slowing global economic growth, although long-term air cargo growth remains in line with previously estimated trend indicating strong long term growth.

Looking further ahead, airlines are expected to return to operating profitability in the last quarter of 2023, after three consecutive years of losses. Air passenger demand in 2024 is expected to be stronger, at around 4% higher than 2019. In terms of Compound Annual Growth Rate (CAGR), this translates to a growth of 0.7% over the 2019-2024 period.

This forecasted recovery and growth for the world of civil aviation comes with the caveat that risks affecting international air transport do not escalate from current levels.

IATA SIGNS COOPERATION AGREEMENT WITH THE GOVERNMENT OF THE FEDERAL REPUBLIC OF SOMALIA

The International Air Transport Association (IATA) and the Government of the Federal Republic of Somalia agreed to deepen and formalize cooperation with the aim of strengthening the economic and social benefits of aviation in Somalia.

Under an agreement signed by Kamil Alawadhi, IATA's Regional Vice President, Africa and the Middle East and H.E. Fardowsa Osman Egal, the Minister of Transport and Civil Aviation, Federal Republic of Somalia, a new framework was established that will also see an expansion of IATA's activities in the country.

"Aviation is a significant contributor to the UN's Sustainable Development Goals (SDGs), so the potential for a strengthened air transport sector to contribute to Somalia's development is enormous. This agreement aims to realize that potential for social and economic development by focusing on global standards and best practices. H.E. Minister Fardowsa Osman Egal has a strong vision for a successful aviation sector to contribute to a more prosperous Somalia. And we are determined to support that by turning the words of our agreement into real actions," said Alawadhi.

The agreement provides the framework to support IATA's mission for aviation in Africa: the creation of a safe, efficient, sustainable, and economical air transport sector that generates growth, creates jobs, and facilitates international trade and tourism as well as playing an essential role in supporting the UN SDGs through generating connectivity between nations.

"Aviation is essential to the success of Somalia's development plans. The Government of Somalia is committed to developing its air transport sector to help promote long-term social and economic growth in the country. And we will ensure that global best practices are at the core of development. This agreement will pave the way for closer cooperation on the priorities for aviation in the country," said Egal.

Google Banner Ad

FAA PROPOSES $1.1M FINE AGAINST UNITED AIRLINES FOR ALLEGEDLY NOT PERFORMING MAINTENANCE INSPECTION

The Federal Aviation Administration (FAA) proposed a $1,149,306 civil penalty against United Airlines for allegedly conducting flights from June 2018 to April 2021 in Boeing 777 aircraft that were not in airworthy condition.

The FAA alleges United in 2018 removed the Fire System Warning Check from its Boeing 777 Preflight Check List, an inspection task required in its Maintenance Specifications manual. Removal of the check resulted in United's failure to perform the required check and the operation of aircraft that did not meet airworthiness requirements.

United Airlines has 30 days to respond to the FAA after receiving the agency's enforcement letter.

Google Banner Ad

QATAR AIRWAYS AND AIRBUS REACH AMICABLE SETTLEMENT IN LEGAL DISPUTE

Qatar Airways and Airbus are pleased to have reached an amicable and mutually agreeable settlement in relation to their legal dispute over A350 surface degradation and the grounding of A350 aircraft. A repair project is now underway and both parties look forward to getting these aircraft safely back in the air.

The details of the settlement are confidential and the parties will now proceed to discontinue their legal claims. The settlement agreement is not an admission of liability for either party.

This agreement will enable Qatar Airways and Airbus to move forward and work together as partners.

Google Banner Ad

AIR CARGO CLOSES 2022 NEAR PRE-PANDEMIC LEVELS.

The International Air Transport Association (IATA) released data for global air freight markets showing that 2022 full-year demand for air cargo took a significant step back from 2021 levels but was close to 2019 performance.

Global full-year demand in 2022, measured in cargo tonne-kilometres (CTKs*), was down 8.0% compared to 2021 (-8.2% for international operations). Compared to 2019, it was down 1.6% (both global and international).

Capacity in 2022, measured in available cargo tonne-kilometres (ACTKs), was 3.0% above 2021 (+4.5% for international operations). Compared to 2019 (pre-COVID) levels, capacity declined by 8.2% (-9.0% for international operations).

December saw a softening in performance: global demand was 15.3% below 2021 levels (-15.8% for international operations). Monthly cargo demand tracked below 2021 levels from March 2022. Global capacity was 2.2% below 2021 levels (-0.5% for international operations). This was the tenth consecutive monthly contraction compared to 2021 performance.

2022 ended with mixed signals:

Global new export orders, a leading indicator of cargo demand, have stayed at the same level since October. For major economies, new export orders are shrinking except in Germany, the US, and Japan, where they grew.

Global goods trade decreased by 1.5% in November, down from a 3.4% increase in October. The Consumer Price Index for G7 countries indicated inflation tracking at 6.8% for December. The 0.6 percentage point drop compared to November (7.4%) was the largest over the course of year. Inflation in producer (input) prices reduced to 12.7% in October, its lowest level so far in 2022.

"In the face of significant political and economic uncertainties, air cargo performance declined compared to the extraordinary levels of 2021. That brought air cargo demand to1.6% below 2019 (pre-pandemic) levels. The continuing measures by key governments to fight inflation by cooling economies are expected to result in a further decline in cargo volumes in 2023 to -5.6% compared to 2019. It will, however, take time for these measures to bite into cargo rates. So, the good news for air cargo is that average yields and total revenue for 2023 should remain well above what they were pre-pandemic. That should provide some respite in what is likely to be a challenging trading environment in the year ahead," said Willie Walsh, IATA's Director General.

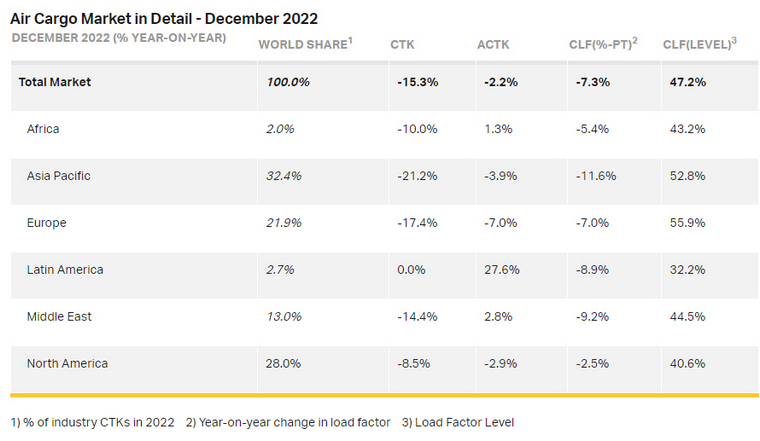

Air Cargo Market in Detail - December 2022

DECEMBER 2022 (% YEAR-ON-YEAR)

1) % of industry CTKs in 2022 2) Year-on-year change in load factor 3) Load Factor Level

2022 Regional Performance

Asia-Pacific airlines posted an 8.8% decrease in demand in 2022 compared to 2021 (-7.4% for international operations) and a capacity increase of 0.5% (+5.8% for international operations). Compared to 2019 (pre-COVID levels), demand was 7.8% below (-3.9% for international operations) and capacity was down 17.2% (-12.2% for international operations). In December, Asia-Pacific airlines recorded the worst performance of all regions, posting a 21.2% decrease in demand (-20.4% for international operations) compared to 2021. Capacity fell 3.9% (-1.4% for international operations) during the same period. Airlines in the region continue to be impacted by lower levels of trade and manufacturing activity and disruptions in supply chains due to China's rising COVID cases.

North American carriers reported a 5.1% decrease in demand in 2022 compared to 2021 (-6.3% for international operations) and a capacity increase of 4.2% (+4.9% for international operations). Compared to 2019 (pre-COVID levels), demand was 13.7% above (+12.7% for international operations) and capacity was up 8.2% (5.1% for international operations). In December, airlines in the region reported an 8.5% decrease in demand for both global and international operations, compared to 2021. Capacity fell 2.9% (+1.8% for international operations) during the same period.

European carriers posted the worst year-on-year performance of all regions, with an 11.5% decrease in demand in 2022 compared to 2021 (-11.8% for international operations). During the same period, airlines posted a capacity increase of 0.5% for both global and international operations. Compared to 2019 (pre-COVID levels), demand was 8.7% below (-9.1% for international operations) and capacity was down 16.5% (-17.3% for international operations). In December, airlines in the region posted a 17.4% decrease in demand (-17.9% for international operations) compared to 2021. Capacity fell 7.0% (-7.4% for international operations) during the same period. Airlines in the region continue to be most affected by the war in Ukraine.

Middle Eastern carriers reported a decrease of 10.7% for global and international demand in 2022 compared to 2021 and an increase in capacity of 4.3% (+4.5% for international operations). Compared to 2019 (pre-COVID levels), demand was 1.6% above for global and international operations and capacity was down 6.3% (-6.1% for international operations). In December airlines in the region posted a 14.4% decrease in demand for both global and international operations compared to 2021. Capacity increased 2.8% (+3.0% for international operations) during the same period.

Latin American carriers posted the strongest year-on-year performance of all regions, with an 13.1% increase in demand in 2022 compared to 2021 (+15.0% for international operations). During the same period, airlines posted a capacity increase of 27.1% (+27.8% for international operations). Compared to 2019 (pre-COVID levels), demand was 4.3% below (-2.6% for international operations) and capacity was down 14.3% (-10.8% for international operations). In December airlines in the region posted stagnant growth in demand (+2.3% for international operations) compared to 2021. Capacity grew 27.6% (+32.7% for international operations) during the same period.

African airlines reported a decrease in demand of 1.4% for global and international demand in 2022 compared to 2021 and an increase in capacity of 0.3% (-0.2% for international operations). Compared to 2019 (pre-COVID levels), demand was 8.3% above (+9.4% for international operations) and capacity was down 15.3% (-14.2% for international operations). In December, airlines in the region posted a 10.0% decrease in demand for both global and international operations compared to 2021. Capacity grew 1.3% (+0.2% for international operations) during the same period.

Google Banner Ad

FAA STATEMENT ON AERO MICRONESIA INC.

The FAA suspended the operating authority of Aero Micronesia Inc., doing business as Asia Pacific, to conduct operations after the carrier was unable to demonstrate that its pilots were properly trained.

The agency issued an Emergency Order of Suspension on 1 Feb. 2023, after the company failed to produce records showing that the two individuals who provide proficiency checks for company pilots were properly trained and qualified for the past two years. Under the regulations, any flight check provided by these two individuals is invalid, meaning that none of the company's pilots are currently qualified to fly.

The FAA notified Asia Pacific in December that it was in apparent non-compliance with the regulations and urged the carrier to suspend operations until the matter was resolved. The Guam-based airline continued to operate.

Under the terms of the emergency suspension, the airline must immediately surrender its air carrier certificate to the FAA and cease operations until the company is able to provide complete records. Failure to surrender the certificate could result in fines of up to $16,108 a day.

Google Banner Ad

Google Banner Ad

|

|